Today we're going to take a closer look at common wall construction in these Swedish factory houses we've been studying. The Swedes build their energy efficient homes using fairly ordinary materials that are not very different than what we use in the US. Ultimately we would like to propose a analogous wall system composed of materials widely available in the US - an American version of the Swedish wall. But first we have to look closer at what they are building.

Several of our earlier posts in the Letters from Sweden series touched on this. Most recently we looked at an automated assembly line, and through observing the assembly process we could see the various layers of the wall. Now we'll look closely at each layer using examples from a few factory web sites. Some Swedish factories market themselves as being green and some offer passive house options straight from the factory. What we will look at here is what I've found in my research to be very typical of Swedish house construction. A baseline if you wish of what the average wall in a Swedish house looks like.

First we must put this in perspective with a quick consideration of the average construction in the US. In the USA a comparitve average wall system would be 2x4 stud wall, with strand board and vinyl siding over tyvek on the outside, gypsum drywall on the inside, filled with R13 fiberglass batts. That's it. This wall is thin, cheap, and has poor energy performance. If you are in a colder US climate this may be offered with 2x6 studs and R19 insulation, or with a thin foam insulation layer in place of the strand board on the 2x4 wall. This is just enough to meet our meager energy code requirements. In the US vapor barriers which are supposed to keep the interior of our walls free of moisture typically come bound to the insulation batts. This makes for an open seam at every stud, and a hole where ever a switch or outlet is placed. As a result the wall is not air tight, not even close.

Ok, that is the typical in the US. Let's look at Sweden.

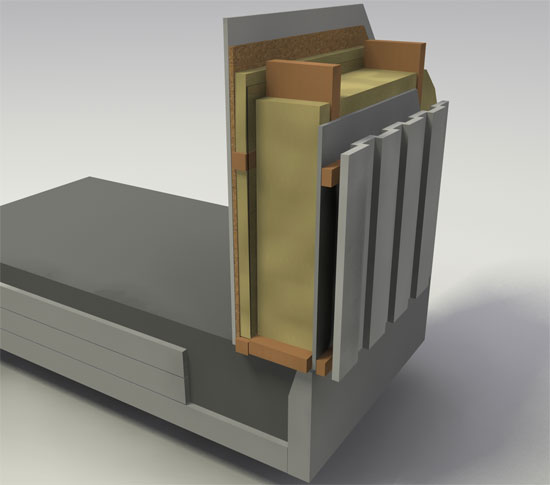

This wall construction diagram is from a factory called RejnäsVillan and is a good typical example of their practices. This diagram can be found on their site here.

Starting with the framing, they are using 195mmx47mm studs, which translates roughly to 7 3/4" deep, or a half inch deeper than our 2x8s. This stud space is completely filled with mineral wool insulation which is denser and has a higher R-value per inch than our typical R13 and R19 insulation.

Moving to the outside the stud wall is sheathed with a panel that is either a hardboard (like a masonite) or a gypsum board cladding. This is covered with an air barrier like tyvek if it is not already a component of the hardboard/gypsum panel. This is in turn layered with horizontal furring, approximately 47mm thick, and then finally clad with thick solid wood siding boards.

Moving to the inside, directly in board of the studs the wall receives a heavy plastic vapor barrier that is applied in a continuous sheet. On top of that is a horizontal furring and this 47mm space filled with more mineral wool insulation. This is in turn clad with a particle board layer, or sometimes solid tongue and groove wood. And finally the interior gypsum panels. This deserves some explanation. The interior furring space serves a the place to run wires and plumbing, so there is never any electrical boxes making holes in the vapor barrier layer. This allows the house to be built air tight. This is analogous to the "disentanglement" layer that Bensonwood uses in their wall systems. The particle board layer is a convenience, to allow a homeowner to hang shelves, pictures, or cabinets anywhere without concern - there is always solid anchoring. The feeling is the additional material is cheap, and its presence adds greatly to quality, a logic I find difficult to fault.

Last of all this layering of furring strips and studs creates a thermal break that decreases the direct conduction of heat through the studs. This is something that Passive House proponents struggle with here in the US, leading many to opt for exterior foam layers to isolate the studs. The problem with this strategy is the foam is an inherent vapor barrier. In a heating climate that barrier wants to be on the inside. It can be done on the outside, but only at risk that with extreme temperature ranges the dew point could swing into the stud space and cause condensation, and then reduced insulation performance and mold hazard. I think the Swedish strategy is superior, and it is effective - Swedish factories use the same strategy in their Passive House wall systems.

So why do the Swedes build such quality walls, and the US not so much? Number one as a nation they were committed to reducing their energy consumption and they've been remarkably successful at that. We have not. Number two, their factory process allows them to build sophisticated walls like these efficiently. With our cheap walls factory building makes little difference. There is simply not enough value there to save very much. Its just as profitable to build on site when your walls are so cheap and simple. The Swedes however use the factory to make every house very high in quality, and very energy efficient. If we ever hope to do the same we will have to turn to a similar factory process.

Next we'll speculate on what a similar wall might look like built in the US.